These Crypto Asset Classes Could Be Future Market Drivers: Santiment

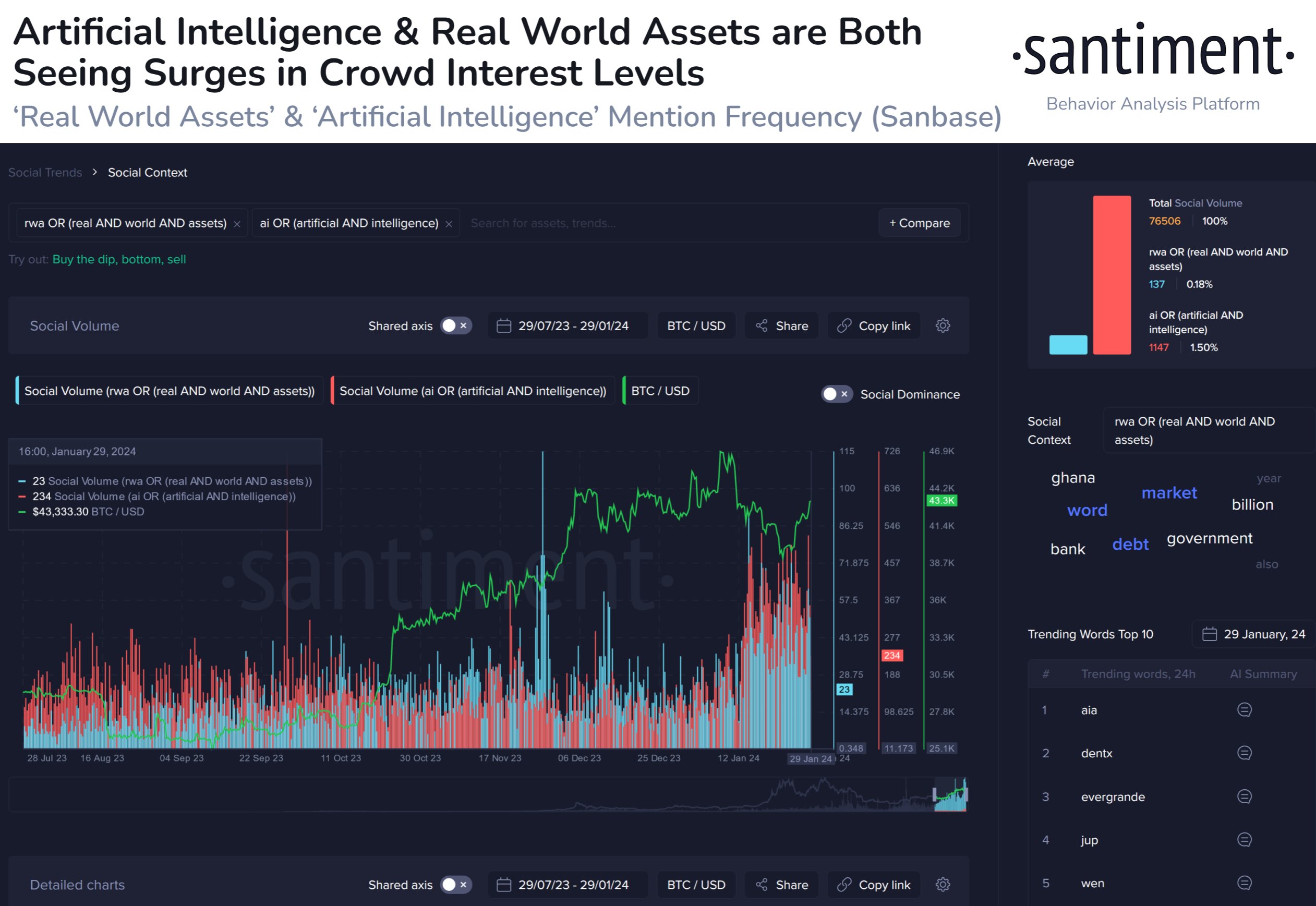

Analytics firm Santiment suggests that Artificial Intelligence (AI) and Real-World Assets (RWA) show potential to be future drivers for the crypto market. The firm has reported a surge in interest in these topics based on social media discussions. The high social volume for AI and RWA indicates increased interest from the crowd, projecting them to be future market drivers. Santiment has also listed some cryptos that connect with these topics. Recent market activity has seen a 30% surge in Avalanche (AVAX) price, clearing the $35 level. This indicates growing interest in these assets and suggests they could be ones to keep an eye on in the future.

These Crypto Asset Classes Could Be Future Market Drivers: Santiment

The crypto market has been booming in recent years, and with the rise of new digital assets, investors and analysts are constantly on the lookout for the next big market driver. Santiment, a leading provider of on-chain, social, and development data for cryptocurrency projects, has identified several crypto asset classes that could drive future market growth.

According to Santiment, the resurgence of decentralized finance (DeFi) projects could be a significant market driver in the near future. DeFi has been gaining traction in the crypto space, with a wide range of applications such as lending, borrowing, and decentralized exchanges. Santiment’s data shows that DeFi projects have seen a significant increase in on-chain activity and a growing community of users. This could indicate that these projects are gaining popularity and could drive market growth in the coming months.

Another asset class that Santiment believes could be a future market driver is non-fungible tokens (NFTs). NFTs are unique digital assets that represent ownership of a specific item, such as artwork, music, or collectibles. Santiment’s data shows that the NFT market has been growing rapidly, with an increasing number of transactions and a growing community of creators and collectors. This could indicate that NFTs are becoming more mainstream and could drive market growth in the future.

Santiment also points to the growing interest in layer 2 solutions as a potential market driver. Layer 2 solutions are technologies that aim to improve the scalability and efficiency of blockchain networks. Santiment’s data shows that layer 2 projects have been gaining traction in the crypto space, with a growing number of transactions and a growing community of developers and users. This could indicate that layer 2 solutions are becoming more popular and could drive market growth in the near future.

In addition to these asset classes, Santiment also highlights the potential for decentralized autonomous organizations (DAOs) to be a future market driver. DAOs are organizations that are governed by smart contracts and run on a blockchain network. Santiment’s data shows that the interest in DAOs has been growing, with an increasing number of projects and a growing community of participants. This could indicate that DAOs are gaining traction and could drive market growth in the coming months.

Santiment’s analysis of these potential market drivers is based on its comprehensive data and insights into the crypto space. The company provides a wide range of on-chain, social, and development data for cryptocurrency projects, which allows investors and analysts to make informed decisions about their investments.

In a recent interview, Santiment’s CEO, Maksim Balashevich, stated, “We believe that these asset classes have the potential to be significant market drivers in the future. Our data shows that these projects are gaining traction and could drive market growth in the coming months. We are constantly monitoring the market to provide insights and data that can help investors make informed decisions about their investments.”

As the crypto market continues to evolve, it is important for investors and analysts to stay informed about the latest trends and developments. Santiment’s analysis of potential market drivers provides valuable insights into the future of the crypto space and could help investors make informed decisions about their investments.

In conclusion, Santiment has identified several crypto asset classes that could be future market drivers, including decentralized finance (DeFi) projects, non-fungible tokens (NFTs), layer 2 solutions, and decentralized autonomous organizations (DAOs). The company’s data shows that these projects are gaining traction and could drive market growth in the coming months. As the crypto market continues to evolve, it is important for investors and analysts to stay informed about the latest trends and developments in order to make informed decisions about their investments.

I don’t own the rights to this content & no infringement intended, CREDIT: The Original Source: www.newsbtc.com